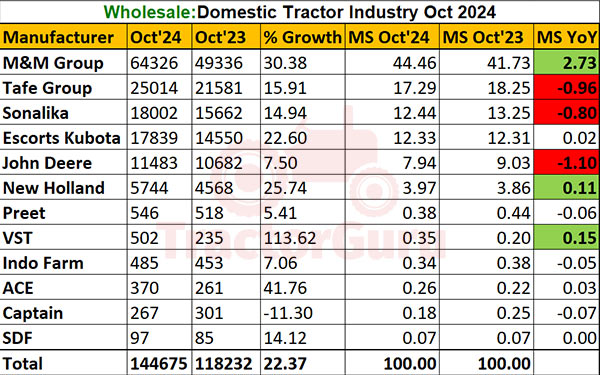

In October 2024, the domestic tractor industry in India demonstrated impressive growth. Total wholesale sales reached 144,675 units, a 22.37% increase over the previous year. Market leaders like Mahindra & Mahindra Group, Tafe Group, and Sonalika continued to drive the industry.

However, several brands reported significant gains in sales and market share. This growth reflects strong demand across the agricultural sector, as manufacturers capitalized on the season to boost their sales. Here’s a closer look at how each major tractor player performed in the industry for October 2024.

Mahindra & Mahindra Group was the leading tractor brand in October 2024, selling an impressive 64,326 units. This was a strong increase of 30.38% from the previous year when they sold 49,336 units. M&M’s share of the total market also grew, moving from 41.73% last year to 44.46% this year. This growth shows that M&M is capturing more of the market, gaining an extra 2.73% compared to last year. Mahindra’s strong performance reflects its popularity among farmers and its ability to meet rising demand.

Tafe took second place in terms of sales volume, with 25,014 units sold in October 2024. This is a 15.91% increase from October 2023, when they sold 21,581 units. However, despite selling more tractors, Tafe’s market share actually dropped a little, from 18.25% last year to 17.29% this year. This 0.96% drop in market share suggests that while Tafe’s sales grew, other brands grew faster, slightly reducing Tafe’s hold on the overall market.

Sonalika sold 18,002 units in October 2024, showing a solid 14.94% growth over the previous year, when they sold 15,662 units. However, similar to Tafe, Sonalika’s market share decreased from 13.25% to 12.44%, a drop of 0.80%. This slight reduction indicates that although Sonalika saw positive sales growth, other brands expanded faster, which affected Sonalika’s share in the total market.

Escorts Kubota had a strong performance with 17,839 units sold, marking a 22.60% increase from last year’s sales of 14,550 units. The brand’s market share stayed relatively stable, moving from 12.31% in October 2023 to 12.33% this year. This small gain of 0.02% shows that Escorts Kubota managed to keep its position in the market, growing at a similar rate to the overall industry.

John Deere sold 11,483 tractors in October 2024, which is a 7.50% increase from the previous year, when they sold 10,682 units. However, their market share dropped from 9.03% last year to 7.94% this year, a decrease of 1.10%. This decline suggests that, although John Deere saw some growth, it was not enough to keep up with the faster pace of other brands, leading to a reduction in their share of the market.

New Holland sold 5,744 units in October 2024, marking a strong 25.74% increase over the previous year’s sales of 4,568 units. This growth allowed New Holland to slightly increase its market share, moving from 3.86% last year to 3.97% this year, a gain of 0.11%. This shows that New Holland was able to capture a small additional portion of the market, benefiting from increased demand.

Preet sold 546 units in October 2024, which is a modest increase of 5.41% from the 518 units sold last year. Despite this growth, Preet’s market share fell slightly, from 0.44% in October 2023 to 0.38% this year, a decrease of 0.06%. This minor decline suggests that Preet’s growth was slower than the overall market, leading to a small reduction in its share.

VST saw an impressive growth of 113.62%, selling 502 units in October 2024 compared to only 235 units the previous year. This large increase helped VST’s market share rise from 0.20% to 0.35%, a gain of 0.15%. This significant growth indicates that VST is becoming more popular and is gaining a stronger foothold in the market.

Indo Farm sold 485 tractors in October 2024, marking a 7.06% increase from last year’s 453 units. However, its market share dropped slightly, from 0.38% to 0.34%, a decrease of 0.05%. This suggests that while Indo Farm saw some growth, it was slower than that of other brands, resulting in a slight decrease in its market position.

ACE had a strong month, with sales up by 41.76% to reach 370 units in October 2024, compared to 261 units the previous year. This growth helped ACE’s market share increase slightly from 0.22% to 0.26%, a gain of 0.03%. ACE’s performance shows that it is gaining traction in the market, likely due to an increase in demand for its tractors.

Captain experienced a decline in sales, with 267 units sold in October 2024, down 11.30% from the previous year’s 301 units. Its market share also dropped from 0.25% last year to 0.18% this year, a loss of 0.07%. This decline suggests that Captain may be facing challenges in keeping up with the competition, resulting in lower sales and a reduced market presence.

SDF saw a steady 14.12% growth, selling 97 units in October 2024 compared to 85 units last year. Its market share remained stable at 0.07%, showing no significant change. SDF’s performance suggests moderate growth without any major shifts in its market position.

The overall tractor market in October 2024 showed strong growth, with total sales reaching 144,675 units, a 22.37% increase compared to October 2023’s total of 118,232 units.

Website - TractorGuru.in

Instagram - https://bit.ly/3wcqzqM

FaceBook - https://bit.ly/3KUyG0y